News

Finance Asset Management

Finance Asset Management

Managing money can be a daunting task for anyone, not least for professional rugby players who are can often be faced with contractual issues. The Player Development Programme can offer players assistance in basic financial management, budgeting and saving.

Basic Financial Management

Financial Planning – Start Early

Changing demographics, including increased life expectancy, improving living standards, a decline in the tax base due to changes in the ratio of income-tax-paying-citizens to retired citizens is altering radically how pensions are funded. These forces are driving the progressive transfer of responsibility for pension provision away from the state and the employer to the individual.

For example, recent policy changes have increased the retirement age for State pension purposes to 68 from 65. In the private section there has been a dramatic move away from Defined Benefit to Defined Contribution pension schemes: this effectively transfers responsibility for pension funding to the individual. In consequence, for most individuals the capital accumulated to fund retirement is likely to become their most valuable asset, more valuable indeed than their home.

One of the basic principles of financial planning is to start saving at a young age, engage in a disciplined process of saving over a period of decades, and build a significant nest egg over the years. This steady approach applies to investing in all financial assets, not just savings, for instance accumulation of stocks or of a pension fund.

By investing as much as we can and starting as early as we can we give our investment time to grow. The longer the time period of the investment the more our money grows, accruing interest to add to our initial investment, allowing our money to work for us rather than us working for our money.

However, there is another factor that can be even more important than the amount invested or duration of the investment – the interest rate earned while invested. For instance, a 1% return on a savings account loses 95% of the potential gain relative to a 7% return!

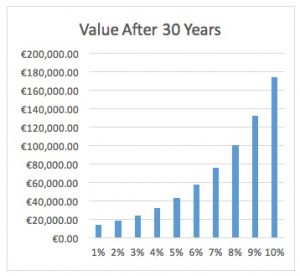

The interest rate, or rate of return, is really the ‘miracle gro’ of investments. It drives the compounding and creation of wealth. We might consider this with a more substantial numerical example of €10,000 invested for 30 years at differing rates of interest:

| Interest Rate | Initial Investment | Value after 30 Years | Interest Earned |

| 1% | €10,000.00 | €13,478.00 | €3,478.00 |

| 2% | €10,000.00 | €18,114.00 | €8,114.00 |

| 3% | €10,000.00 | €24,273.00 | €14,273.00 |

| 4% | €10,000.00 | €32,434.00 | €22,434.00 |

| 5% | €10,000.00 | €43,219.00 | €33,219.00 |

| 6% | €10,000.00 | €57,435.00 | €47,435.00 |

| 7% | €10,000.00 | €76,123.00 | €66,123.00 |

| 8% | €10,000.00 | €100,627.00 | €90,627.00 |

| 9% | €10,000.00 | €132,677.00 | €122,677.00 |

| 10% | €10,000.00 | €174,494.00 | €164,494.00 |

We see that the value of the investment accumulates rapidly as the interest rate of the investment increases. This can be seen more clearly if we put these numbers in a graph:

Of particular note is that the initial investment of €10,000 generates disproportionally dramatically higher interest earned as the interest rate increases. The accelerating rate of interest earned by the investment, is dramatic:

• A 7% interest rate generates €66,123.00 interest on our initial €10,000.00 – a more than six fold increase on our initial investment. (Stated another way every €1 invested accumulates to €7.61, of which €6.61 is interest earned.)

• If we drop that interest rate from 7% to 1% – the interest earned plummet from €6,123 to €3,478, a reduction of 95%

• On the other hand, if interest rate increases from 7% to 10%, the interest earned soars to €164,494, a near 300% increase

These results are startling – no wonder Albert Einstein described the power of compounding as “the eight wonder of the world”.

To summarise: for long term investments, such as pensions, the net value of the investment is critically dependent on the interest rate earned. In fact, the net value of the investment is driven overwhelmingly by the interest earned which typically dwarfs the investor’s initial contribution at even moderate rates of interest.

We conclude by considering some implications for long term financial planning, particularly pension planning:

• Most pension plans work on the assumption that a substantial part of the final pension pot will be generated by returns earned by the investment

• If these rates of return cannot be achieved then the value of pension fund is dramatically reduced: even comparatively small decreases in the rate of return have dramatic effects on the value of the fund

• To compensate for this risk of not having adequate pension funds for retirement it is critically important to start pension contributions early.

The Institute of Banking College of Professional Finance offer part-time postgraduate programmes including; the Graduate Diploma in Financial Planning, the Certified Financial Planner certification examination and the MSc in Financial Services. For more information contact your PDM or visit http://www.iob.ie/

Tax Advice

Primary Tax Considerations from BDO (include BDO logo)

Marital Status

− Are you single or married?

− If married – is this the first tax year of marriage?

Rent Credit (only relevant if renting on 7 December 2010)

− Have you obtained details of the landlord’s name and address and PPS number?

Health Expenses

− Have you incurred medical expenses? (Doctor, Physiotherapy, Prescriptions etc.)

− Have you incurred any non-routine dental expenses? (Root Canal treatment, Crowns etc.)

− Were any of the medical expenses reimbursed by a medical insurance provider?

College Fees

− Have you details and amount of college fees paid? (split into registration fees/tuition fees etc.)

Other Sources of income

− Have you been in receipt of any other sources of income? For example:

o Coaching in schools/colleges

o Summer camps

o Boot sponsorship

o Any other Income sources

o If married, is your spouse in receipt of a source of income?

Legal Advice

McKenna-Durcan tips

Updates from across the other 4 pillars:

Career & Education

Members considering returning to education or enrolling in a postgraduate course need to start looking at their options now as applications for courses starting Sept 2014 have started to open.

Personal Development

Practical, hands-on CV workshops, in conjunction with Accenture, were organised for Connacht and the Women’s Sevens team in May, they will be rolled out to the other provinces in Preseason.

Finance/Asset Management

IRUPA can provide all players with access to a full financial health check service, to discuss savings, investments, mortgages and pensions. A personal relationship manager in each province is dedicated to assisting players and putting a financial plan in place, so money is not a worry upon transitioning out of rugby.

Members leaving the country at the end of the season are eligible to claim tax back on the year as they are being taxed for a 12 month period.

Player Well-Being

Take time to relax and enjoy your holidays and recharge those batteries.

Transitioning

Members who are transitioning out of their clubs, due to completion of their rugby career or moving to another club please contact your PDM for support and guidance.

Latest Posts

Inaugural Past Players Padel Tournament

The Ireland Sports Fund

Making Tracks